Aluminum ingot inventory: Approaching late October, supply side, upstream aluminum smelters actively sold on price strength. Meanwhile, due to winter coal supply guarantees each November, some smelters, led by Xinjiang, accelerated shipment pace over transport capacity concerns, raising expectations for higher in-transit cargo nationwide. Demand side, weak follow-through during seasonal transition, high aluminum prices curbing warehouse withdrawals, and environmental protection-driven production restrictions in central China dampening operating rates created multiple unfavorable factors. Whether the previous destocking trend can continue into November faces severe challenges. According to SMM, domestic aluminum ingot inventory in major consumption areas recorded 619,000 mt this Thursday, up 1,000 mt WoW, but down 31,000 mt from the post-holiday high. On a YoY basis, current inventory lost its advantage of being near three-year lows and increased by 22,000 mt compared to the same period last year.

By region, among major consumption areas: Wuxi—despite some cargo being shipped from South China to East China (e.g., Wuxi), with potential volume expansion if price spreads widen further—saw limited current transfers and low in-transit volume from Xinjiang and Yunnan. With relatively stable withdrawals, destocking may continue. However, Gongyi and Foshan may trend steady or slightly higher due to expected higher in-transit volume and weak withdrawals. Foshan’s spot availability remained ample as replacement aluminum capacity in Yunnan became fully operational this year, while downstream liquid aluminum consumers lacked supporting capacity. Notably for Gongyi, according to the latest SMM news today, Luoyang city activated an orange (Level II) heavy pollution weather alert starting 15:00 October 28, as approved by the municipal government, with removal time to be announced. Affected producers plan production cuts, estimated at 20–30%. Withdrawals faced clear pressure, and some warehouses reported in-transit volume nearly 10,000 mt higher than normal, increasing arrival pressure. Gongyi inventory may exceed 90,000 mt in early November.

In summary, as we enter November, the trend in domestic aluminum ingot inventory is expected to shift from a slight destocking to a slight inventory buildup, which will exert some negative feedback on subsequent aluminum prices. SMM believes that with the end of the traditional peak season, the proportion of liquid aluminum will face some pressure at high levels in November. The supply pressure on aluminum ingots will increase, and the stability of demand is difficult to guarantee under the suppression of high aluminum prices. For the time being, SMM expects the domestic aluminum ingot inventory trend to stabilize with a slight increase in the first half of November, operating in the range of 600,000 to 650,000 mt.

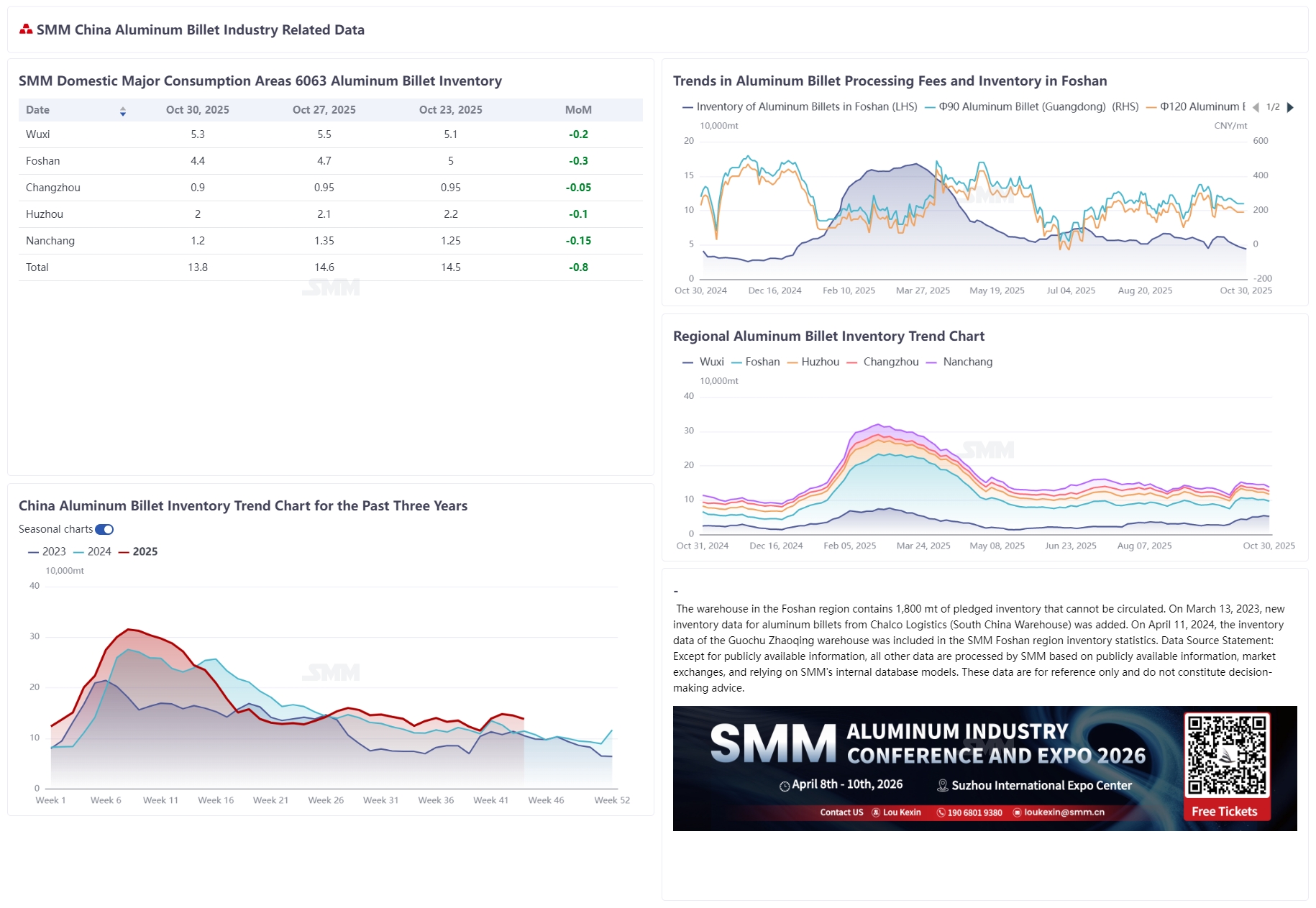

Regarding aluminum billet inventory, according to SMM statistics, the inventory of aluminum billets in major domestic consumption areas was 138,000 mt on October 30, down 8,000 mt from Monday and 7,000 mt from last Thursday. The inventory decline was mainly due to active production cuts by some billet plants since October, resulting in limited growth in warehouse arrivals, coupled with the gradual digestion of previously accumulated plant inventories after concentrated shipments. On the demand side, although end-use demand was suppressed by high aluminum prices, downstream maintained just-in-time procurement, supporting stable warehouse withdrawals. Although market shipments saw a slight rebound, transactions were mostly concentrated among traders, while actual downstream purchasing remained weak, with a predominant wait-and-see attitude due to high prices, indicating that demand-side performance remains pessimistic. Looking ahead to next week, if aluminum prices continue to hover at highs, downstream purchase willingness may be further suppressed. However, considering outbound truck shipments, aluminum billet inventory is expected to continue a slow decline, maintaining a sideways movement in the short term within the range of 130,000–145,000 mt. A rapid destocking scenario still requires a pullback in the price center to stimulate a rebound in end-use demand.

This week, aluminum prices showed an upward breakout trend, putting renewed pressure on aluminum billet processing fees. As of October 30, 2025, processing fees in the Foshan area were quoted at 200/250 yuan/mt, unchanged WoW; in the Wuxi area, they were 180/280 yuan/mt, down 50/20 yuan/mt WoW; and in the Nanchang area, they were 120/170 yuan/mt, down 20/30 yuan/mt WoW. The changes in processing fees were mainly driven by rising aluminum prices, combined with generally moderate market trading sentiment during the week, dominated by just-in-time procurement. Downstream purchasing was weak due to price aversion, resulting in insufficient demand support. However, limited arrivals of aluminum billet inventory and moderate demand for certain billet specifications somewhat curbed the decline in processing fees. Looking ahead to next week, aluminum prices are expected to continue fluctuating at highs, with downstream demand unlikely to see significant improvement. Aluminum billet processing fees are likely to remain under narrow pressure or hold steady, but attention should still be paid to changes in aluminum prices and the extent of downstream demand release.

Data Source Statement: Except for publicly available information, all other data are processed by SMM based on publicly available information, market exchanges, and relying on SMM’s internal database model, for reference only and do not constitute decision-making recommendations.

(Source)

![Alternating Off-Peak and Peak Seasons Face Severe Test, Will Domestic Aluminum Ingot Inventory Change in Early November? [SMM Analysis]](https://businesspro.today/wp-content/uploads/2024/11/sdef.jpg)