A reader asks:

Could you talk about what percentage of stocks that are beating the S&P over the last 5 years also beat the S&P the 5 years before that? I’m curious what names appear in both lists, with factors like pre- and post-COVID, and pre- and post-AI playing a factor. Maybe you could also talk about how stocks that beat the S&P over a 5-year window tend to fare over the next 5 years on average.

This is a good question because so many investors are concerned about concentration in the S&P 500.

It sure feels like it should be a small number of stocks that have outperformed.

In the 5 year period from 2016-2020, the S&P 500 was up a little more than 100%. From 2021 through this week, the S&P 500 is now up around 90% in total.

Those are both very good returns at right around 14%-15% annually.

So how many stocks outperformed in these 5 year windows?

The number was higher than I thought it would be.

There is a caveat here that stocks have moved into and out of the index over this period. The turnover isn’t that high in the S&P 500 but it’s probably 2-4% per year on average.

By my calculations, 149 stocks outperformed the index in the five years ending 2020. That’s around 30% of the total. That’s a fairly low number.

In the last 5 years, 241 stocks outperformed the S&P 500’s return. That’s more like 50% of the total. That’s not bad.

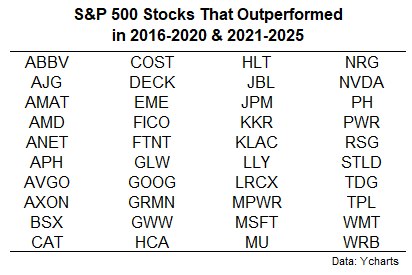

So how many outperformed over both periods?

I counted 40 stocks.

Here is a list of the tickers for those stocks:

It’s a lot of names you know — Microsoft, Google, Nvidia, Walmart, JP Morgan, Costco and Broadcom. Nvidia’s results were off the charts good in both time periods, up 1,500% and 1,300%, respectively.

Some surprising names outperformed in each 5 year period as well — Hilton, Caterpillar and Deckers Outdoors to name a few.

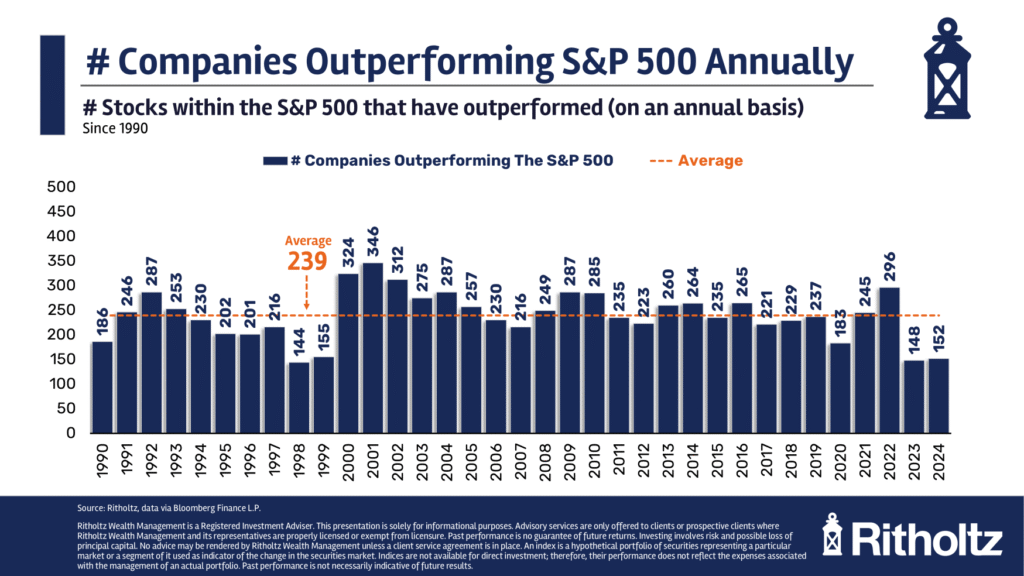

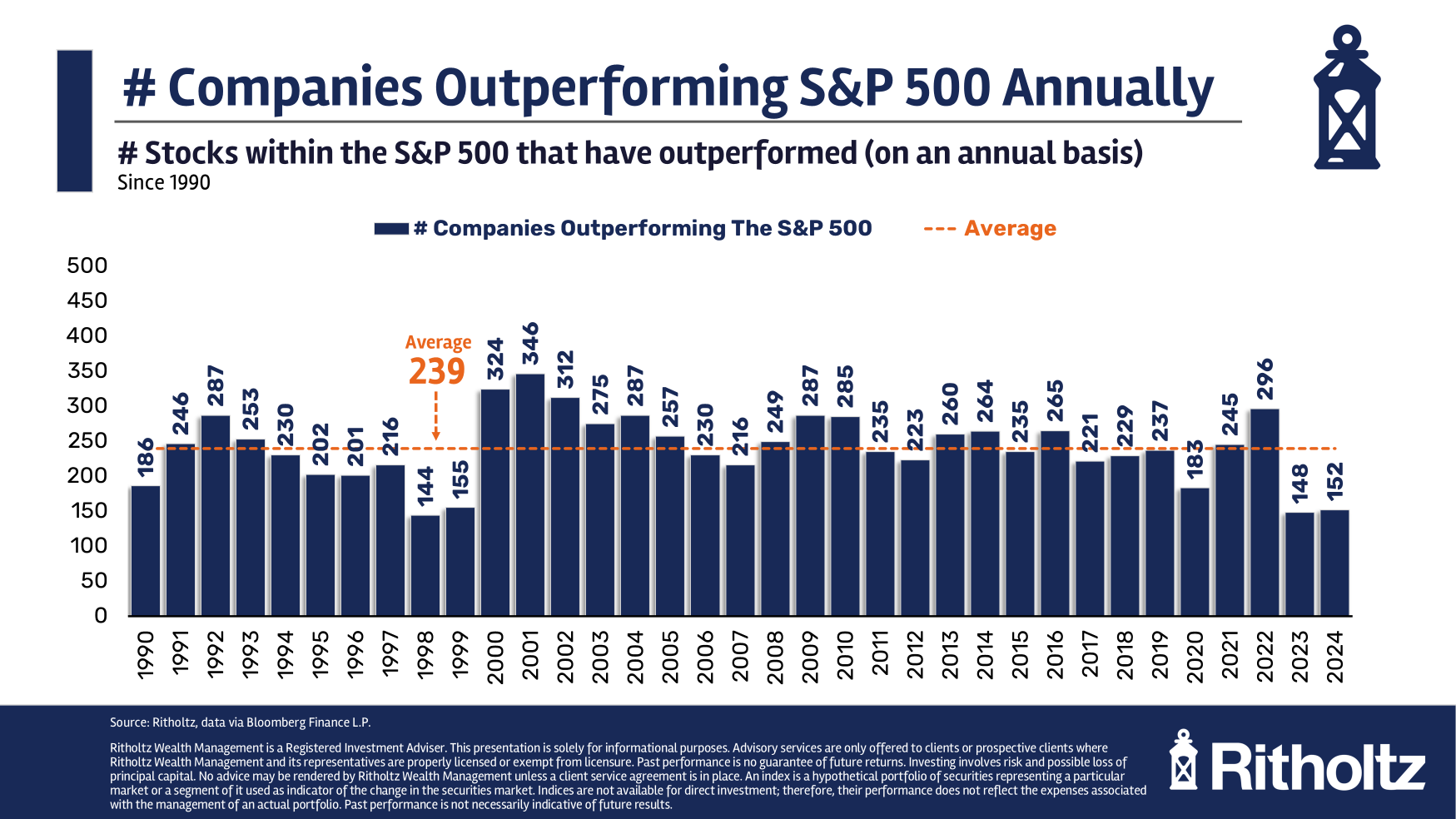

The stock market is getting more and more concentrated at the top but the number of stocks that outperform the index each year is probably higher than you think. Here’s a look at the number of stocks that have outperformed the index performance each year going back to 1990:

The average is just shy of 50% of the total each year.

It’s interesting that it’s basically a coin flip each year on whether you’ll outperform or not with individual securities.

The win rate for outperforming stocks goes down to roughly one-third over the previous 10, 15 and 20 year time frames.

Even with a 50% annual win rate, picking stocks is not easy. But picking the stock-pickers that outperform the market is even harder.

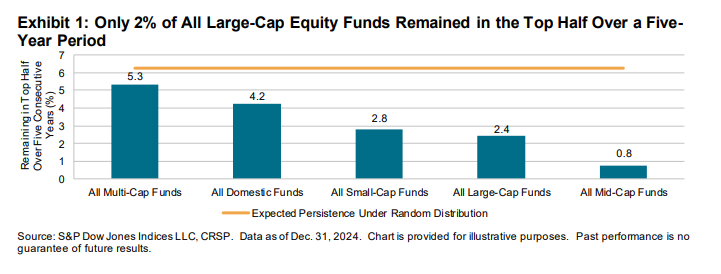

Each year SPIVA updates its Persistence Scorecard to see how many professional fund managers are able to outperform in successive multi-year periods.

The numbers are dreadful.

Take a look at this chart:

Around 2% of all large cap funds were able to remain in the top half of returns for their category in 5 straight years. It gets even worse the further out you go.

SPIVA notes that zero funds that were in the top quartile as of December 2020 remained in the top quartile over the ensuing 4 years. None of the top quartile funds from 2022 were in the top quartile over the next two years. Not one.

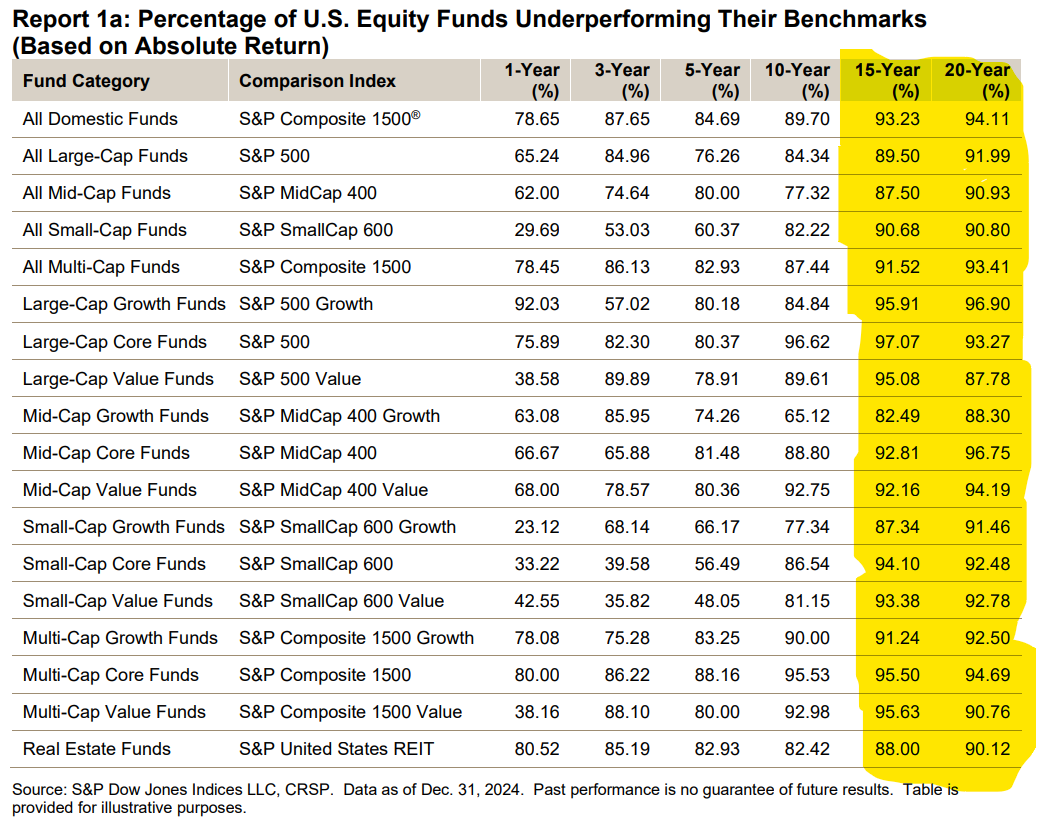

And of course, the number of funds that outperform over the long run is tiny as well:

Over 15 and 20 years just 10% or so of all actively managed funds outperform.

Outperforming is hard. Outperforming consistently is basically unheard of these days.

If you’re going to invest actively, you need to be prepared for lumpy returns, even for the small number of funds and investors who do outperform.

I think one of the reasons the win rate for the number of outperforming stocks is higher than the win rate for fund outperformance is that buy-and-hold is a difficult strategy to stick with psychologically.

Picking the winning stocks is hard but staying invested in them might be even harder.

Buy-and-hold is probably your best bet when owning individual stocks but it’s not easy to sit on your hands and wait.

I answered this question in detail on this week’s all new Ask the Compound:

We also discussed questions about how to die with zero, how diversification works in practice, the Dave Ramsey portfolio and when to make your 529 account more diversified and conservative.

Further Reading:

When Buy-and-Hold Dies

(Source)