Today’s Animal Spirits is brought to you by YCharts and Fabric:

Download your copy of YCharts’ new Fed Rate Cut Deck today, by visiting: https://go.ycharts.com/ycharts-research-fed-rate-cut-deck?utm_source=Animal_Spirits&utm_medium=Original_Research&utm_campaign=2025_Fed_Rate_Cut_Deck&utm_content=Podcast, and get 20% off your initial YCharts Professional subscription when you start your free YCharts trial through Animal Spirits (new customers only).

Join the thousands of parents who trust Fabric to help protect their family. Apply today in just minutes at: https://meetfabric.com/SPIRITS

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky:

It’s worth remembering that while the top-heavy concentration during the late 1990’s was quickly reversed in the early 2000’s, during the 1950’s and 1960’s the market remained top-heavy for many years before excessive valuations finally took their toll. This could take some time. pic.twitter.com/tWF9tVOfUz

— Jurrien Timmer (@TimmerFidelity) September 25, 2025

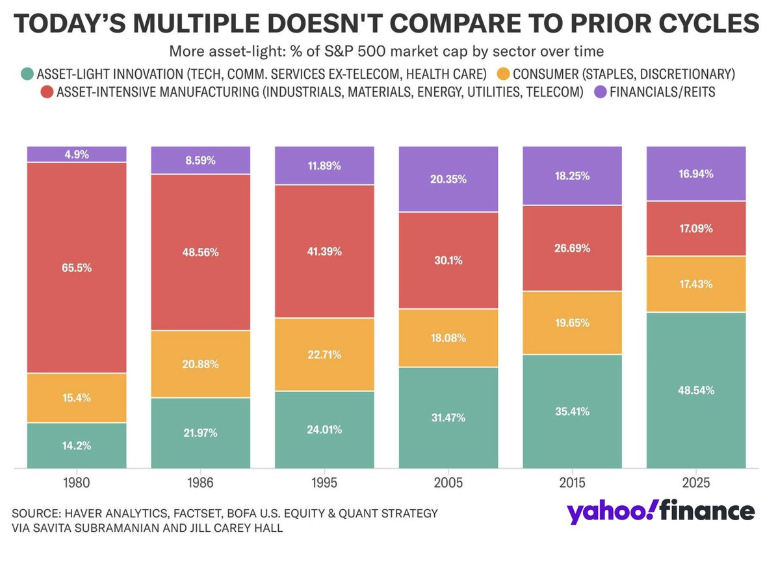

The leaders of the pack, the Mag 7, continue to lead with their earnings and are not showing signs of valuation excesses.

Taking a broader lens to the Mag 7 and looking at the Nifty Fifty, my study of the 50 largest stocks shows that we are nowhere near the valuation extremes… pic.twitter.com/AAlxYYJnei

— Jurrien Timmer (@TimmerFidelity) September 25, 2025

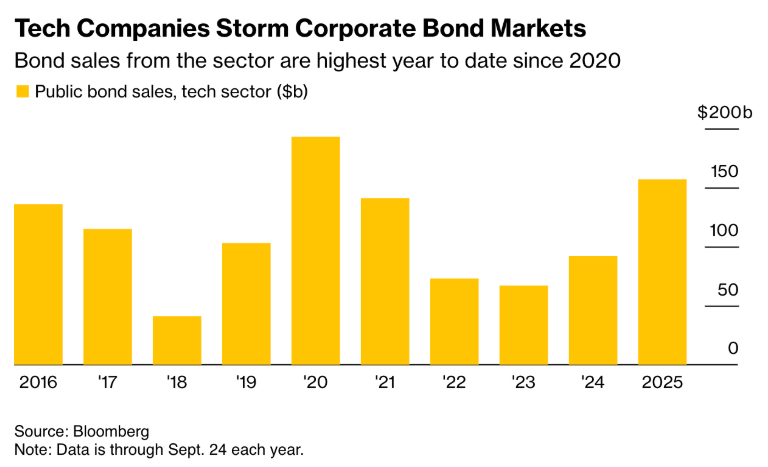

These numbers are in billions. pic.twitter.com/70JtN1RDgi

— Josh Schafer (@_JoshSchafer) September 25, 2025

Global new highs aren’t fading… they have been accelerating.

73 days of more new highs than new lows… longest run since May 2021

This isn’t isolated strength.

👉https://t.co/SFVrMKtCeH pic.twitter.com/2kP631D9F9

— Grant Hawkridge (@granthawkridge) September 29, 2025

The four biggest speculative “quantum” stocks – $IONQ $RGTI $QUBT $QBTS – came into today up an average of 2,750% year-over-year. Analysts estimate combined 2025 revenues for these companies will be about $124 million. They have a combined market cap of $46 billion.

— Bespoke (@bespokeinvest) September 25, 2025

The number of levered ETFs has doubled over the last three years, and assets under management have almost tripled since 2022@LeutholdGroup pic.twitter.com/Y46cUCIPHU

— Gunjan Banerji (@GunjanJS) September 24, 2025

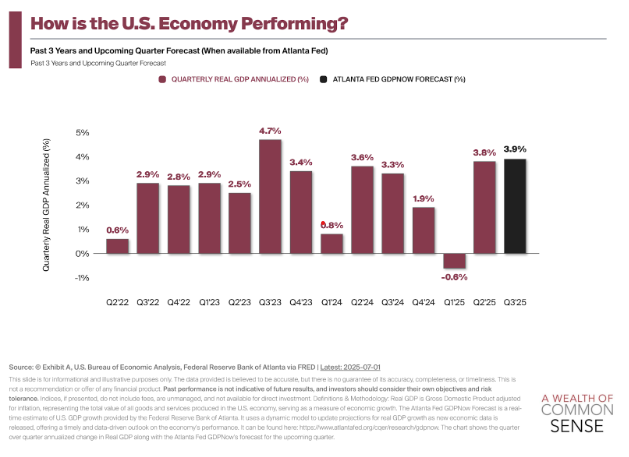

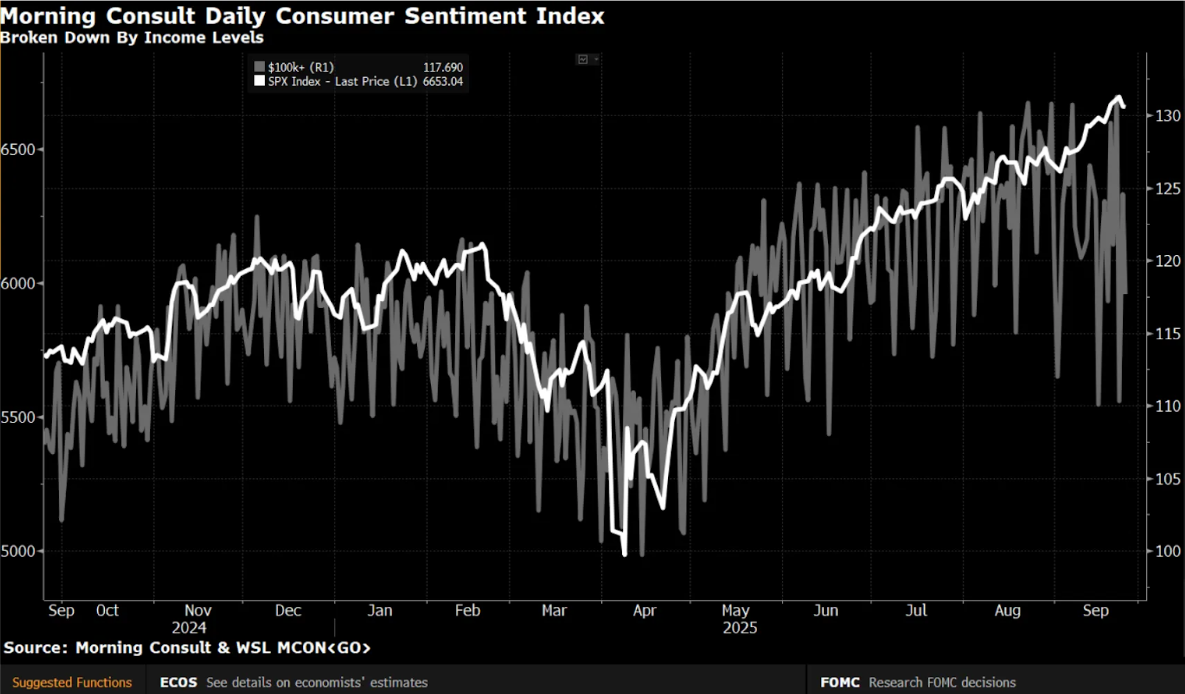

Wow. Final read on Q2 GDP is 3.8%. (The initial report was 3%)

Consumption was +2.5% in Q2. Both goods and services spending was healthy.

The U.S. consumer remained a lot stronger than many thought, even in the midst of a stock market sell-off and a lot of trade uncertainty. pic.twitter.com/qqPNJD7SDP

— Heather Long (@byHeatherLong) September 25, 2025

There is a woman in San Francisco who charges $30k to name your baby.

She started at $100, but she was going to dinner with VCs and a friend told her to charge more and nobody blinked.

The Bay Area might be the best place in the world for this kind of business. pic.twitter.com/6eCy0iUiqE

— Sheel Mohnot (@pitdesi) September 28, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

(Source)