The recession during the onset of the pandemic was the worst quarterly GDP decline since the Great Depression. The unemployment rate shot up from less than 4% to more than 14% in one month.

But this doesn’t count as a true recession.

We shut off the economy like a light switch but then turned it back on. Plus the government sent out trillions of dollars in aid to households, businesses and states. Unemployment insurance was so generous that many people were making more money by not working.

This is why the “recession” lasted just two months.

As far as I’m concerned the last real recession we’ve had in America ended in June of 2009.

That means it’s been 196 months since the last true economic downturn in the U.S. or nearly sixteen-and-a-half years!

Sure, certain industries have taken their lumps in this time1 and the growth hasn’t always been robust but we keep just chugging along.

A lot has changed since the Great Financial Crisis.

New asset classes have popped up. There are far more investors in stocks than ever before. Households are far wealthier. Everyone expects to get bailed out if something goes wrong. There is a whole new subset of degenerate gamblers playing the market. It’s easier than ever to take on leverage and risk in new investment vehicles.

I have no ability to predict when the next recession will happen but I have plenty of questions about what will transpire when it does:

Will the wealth effect make things worse? The top 10% accounts for 50% of consumer spending. High stock prices have a lot to do with this.

Check out this story from Redfin about coming up with a down payment:

“With the housing market in a downturn, the people who are buying are those who are financially comfortable, secure in their jobs, and have money ready and waiting in the bank for a down payment,” said Andrew Vallejo, a Redfin Premier agent in Austin, TX. “For example, a few months ago I helped a buyer close on an $800,000 home with a 50% down payment. They were able to liquidate stocks to make a $400,000 down payment without thinking about it too much, and now their monthly payments are lower.”

There are plenty of households spending more freely because their portfolios are higher than expected due to the hard-charging bull market.

I’m curious to see if it will take a recession to slow down the top 10%.

Will young investors stay invested? Young investors are all-in on the stock market. Most have never experienced the effects from an actual recession while in the working world.

It feels condescending as a middle-aged person to predict that newbie investors will hit the eject button during a recession.

But that happens to a certain segment of every new generation of investors eventually.

Millennials hated the stock market following the 2008 crisis.

Will Gen Z buck the trend?

We shall see.

What will happen to the new private investments? There are trillions of dollars in private credit and even more in private equity. How will these funds react to an economic slowdown?

More importantly, how will investors in these illiquid fund vehicles react?

Will investors continue to buy the dip? Buying the dip is one of the biggest investor trends of the 2020s.

Will that continue once the leveraged ETFs get taken out to the woodshed? Once the speculative stocks get hammered? Once the market doesn’t have a V-shaped recovery?

You could convince me either way on this one.

Will households ramp up their borrowing? Remember when everyone made a big deal about credit card debt hitting $1 trillion?2

It never worried me because the American consumer’s capacity for borrowing has grown even more than our debt levels.

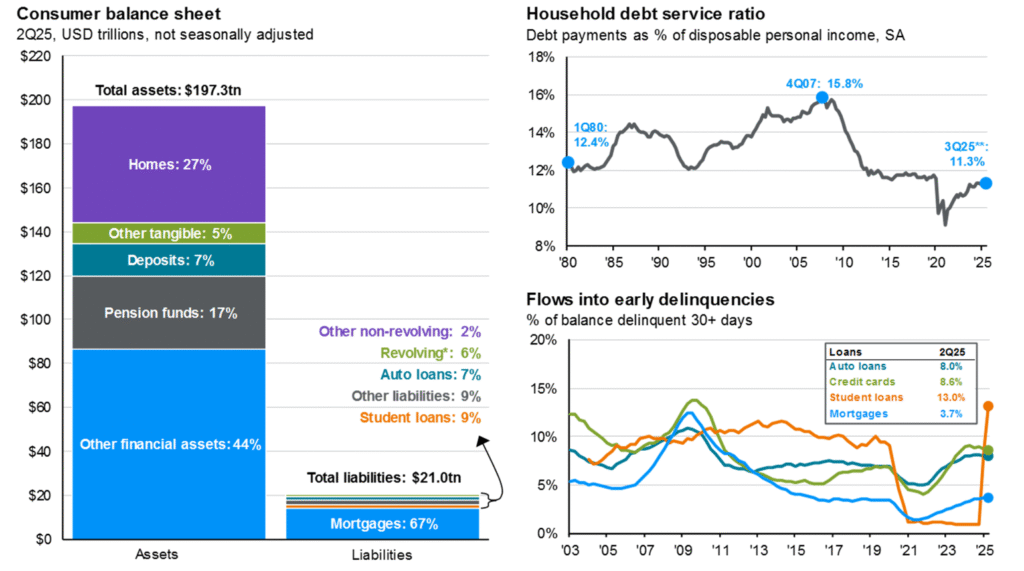

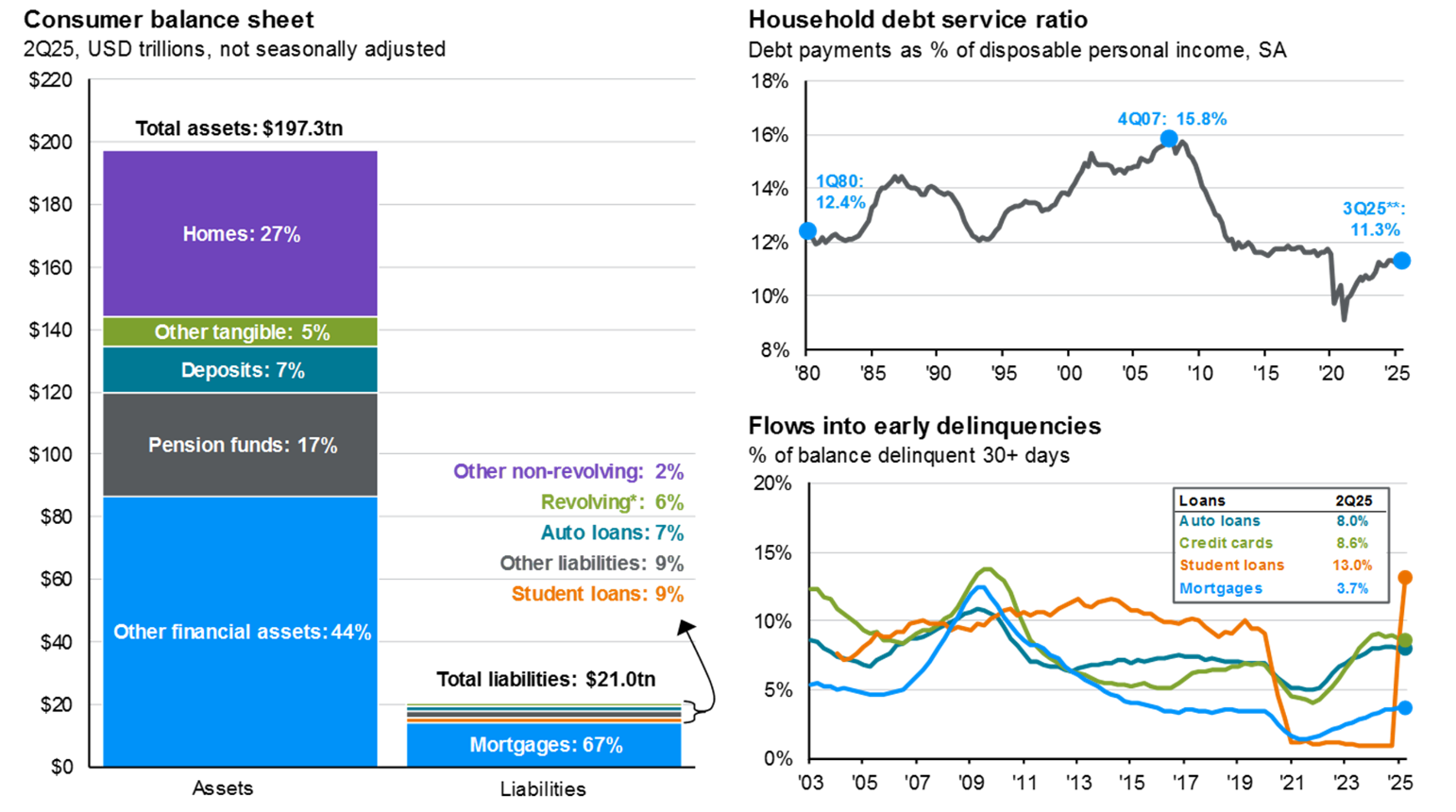

JP Morgan has some good charts that tell the story here:

The assets are far greater than the liabilities. But look at the debt service ratio. Debt payments relative to disposable income are lower now than they were at anytime in the 1980s or 1990s.

Household balance sheets are still in pretty good shape.

In a pinch, consumers have the ability to lever up and borrow more money if need be.

I’m curious to see if households would prefer to rein in their spending habits or borrow money to keep the party going.

We’ll just have to wait for the next recession, whenever it comes, to answer all these questions.

I was in New York City this week and dropped in on The Compound and Friends with Josh, Michael and Sonali Basak to talk about how a recession will impact private credit and much more:

Or check out the podcast version here:

Further Reading:

Can the Stock Market Cause a Recession?

1Housing the past few years, tech in 2022, etc.

2It’s up to $1.2 trillion now.

(Source)