Today’s Animal Spirits is brought to you by Ycharts and Vanguard:

This episode is sponsored by YCharts. Download YCharts’ Great Wealth Transfer Deck free at: https://go.ycharts.com/winning-the-next-generation-of-wealth?utm_source=Animal_Spirits&utm_medium=Original_Research&utm_campaign=Great_Wealth_Transfer&utm_content=Podcast

This episode is sponsored by Vanguard. Learn more at: https://www.vanguard.com/audio

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky:

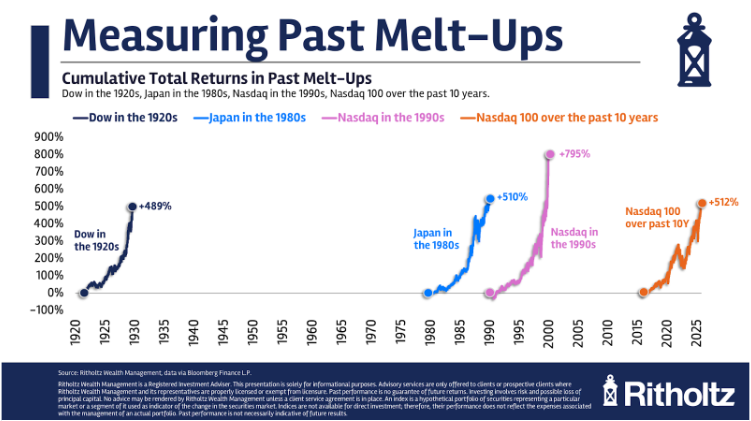

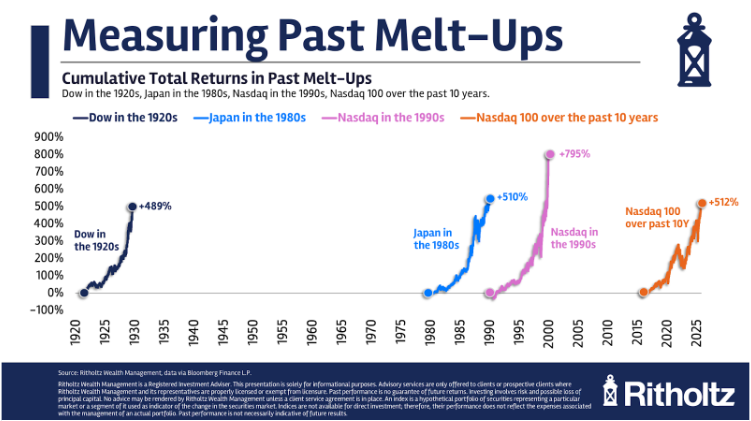

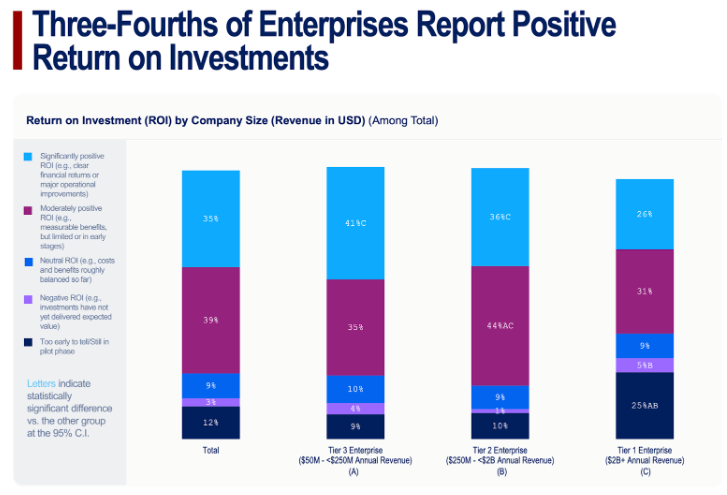

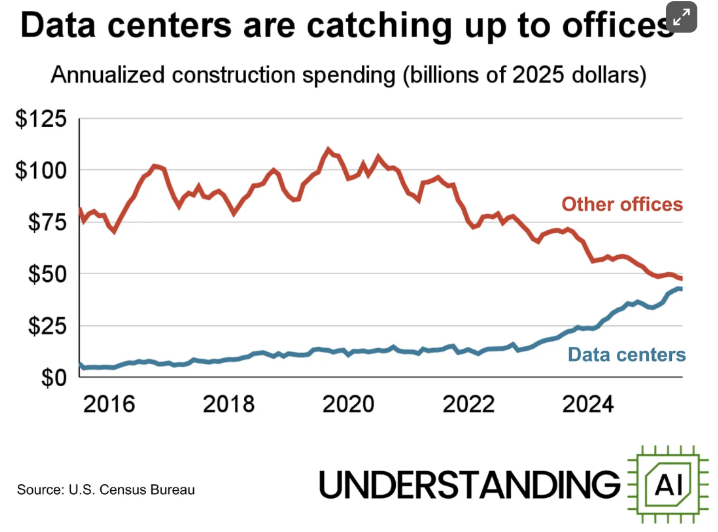

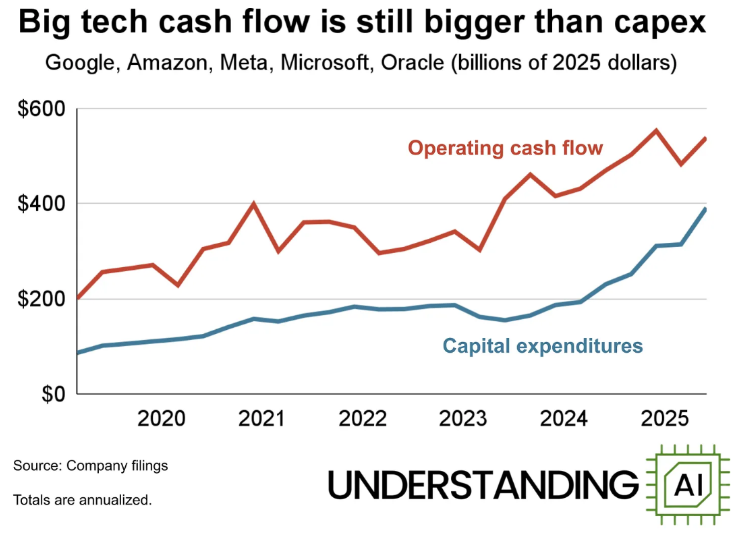

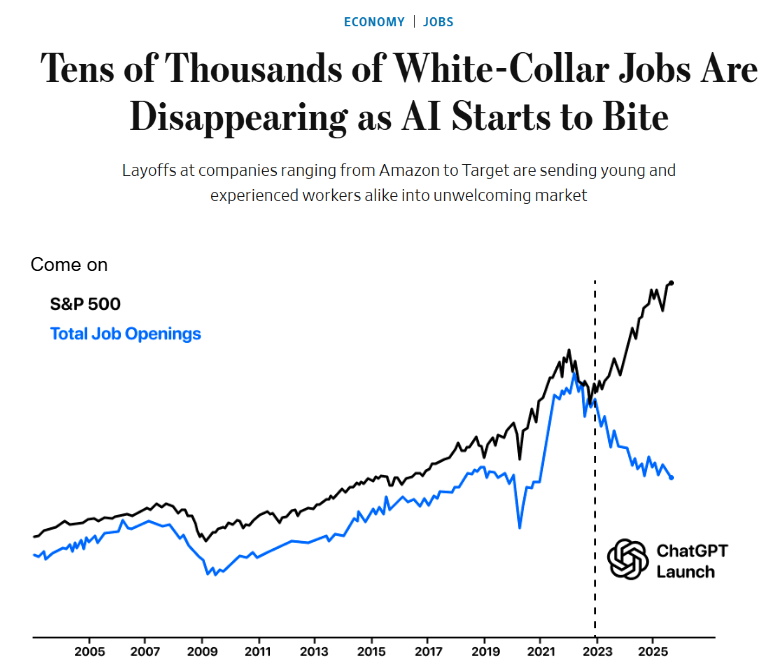

Why AI is Underhyped and Isn’t a Bubble Yet

Here’s why AI isn’t a bubble today. I’ve distilled the data points and ideas from my previous columns and coverage. If you prefer facts and evidence-based reality over vibes and conflated narratives, enjoy!

-Big Tech valuations are…

— tae kim (@firstadopter) October 25, 2025

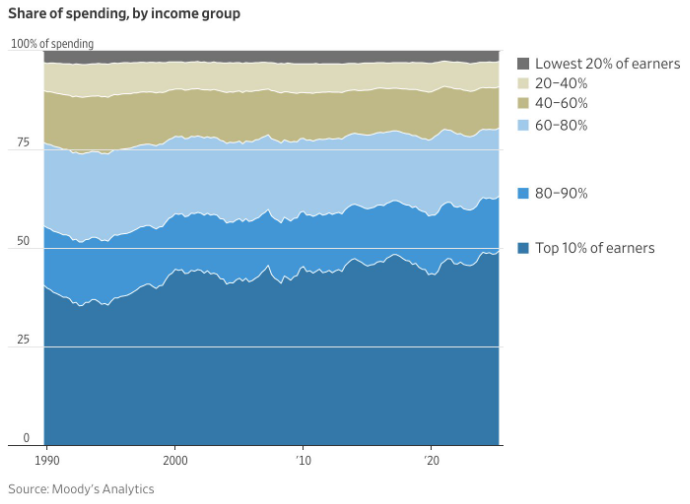

This graph has been floating around every couple months, arguing that the top 10% of earners account for 50% of consumption.

Anyone familiar with economic statistics should intuitively feel it must not be right.

So I dug into it a bit, and indeed, it’s (mostly) not. https://t.co/wnYpZJ3fcY

— Antoine Levy (@LevyAntoine) November 2, 2025

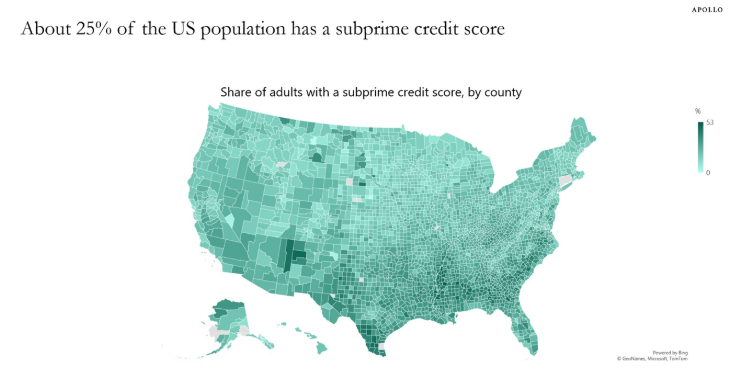

Yeah. We’re fucked, tbh pic.twitter.com/beoCaLC02c

— Del (@TheCartelDel) October 31, 2025

People freaking out over corporate layoffs tend to forget the enormous size and churn of the U.S. labor market.

7.5 million private sector jobs were destroyed in Q4 2024 alone! (But even more were created.) https://t.co/tu2B28qvrR pic.twitter.com/J0i8CWylSN

— John Lettieri (@LettieriDC) October 29, 2025

NEO The Home Robot

Order Today pic.twitter.com/fTQtCHB4UW— 1X (@1x_tech) October 28, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

(Source)