Working in the wealth management business has changed the way I view and interact with so many other aspects of my life.

I’m constantly thinking about everyday interactions through the construct of the stock market and economy. How does this business make money? What does it mean for consumer spending that the airport is so busy today? I wonder how much that family that spends so much money has in their retirement and 529 accounts?

I’m constantly reading. Working in the markets requires you to pay attention to what’s going on. You don’t have to act on it all, but there is a lot of reading, writing and thinking involved. Outside of work I do a lot of reading, writing and thinking too. Right or wrong, it’s hard to turn it off sometimes.

I’ve got better filters now. People in the world of finance are constantly offering opinions, analysis and forecasts. When you’ve been doing this long enough you realize how wrong people are all the time, even the super intelligent ones (or especially them).

Working in finance has given me a much better BS detector to filter out the noise in other areas of life.

Finance has taught me to keep my emotions at bay. It’s been beaten into my skull over and over again the importance of keeping my feelings out of my finances. That’s not always easy but I’ve spent years figuring out how to automate my lesser self out of my financial decisions.

Don’t get me wrong, I’m still human. I overreact, get mad, feel greedy, scared, anxious, nervous, and all of the other emotions.

But sometimes my wife wonders why I don’t show more enthusiasm. I don’t get too high or too low and it makes me think studying behavioral finance all these years has done this to me.1

I’m more comfortable dealing with uncertainty. You have to be willing to say I don’t know on a regular basis when working with the markets and focus on what you can control.

You have no choice.

I find this helps in other areas of my life too. Process over outcomes.

I’m becoming more numb to money. Wealth management requires you to work with a lot of rich people. You basically have two choices with how this makes you feel about money:

(1) You’re continuously jealous.

(2) You become numb to it.

Working with extraordinary wealth has demystified it for me. I know obtaining great riches doesn’t guarantee contentment.

Don’t get me wrong, I still feel greed, fear, envy and all of the other emotions money produces. I respect wealth and everything it can do for you.

But money doesn’t impress me as much as it once did.

Almost every important decision exists in a state of gray. Financial decisions can be difficult because there typically isn’t a right or wrong answer. Most financial choices involve trade-offs and are circumstantial depending on your goals, risk profile, personal make-up, etc.

This is true of most important life decisions.

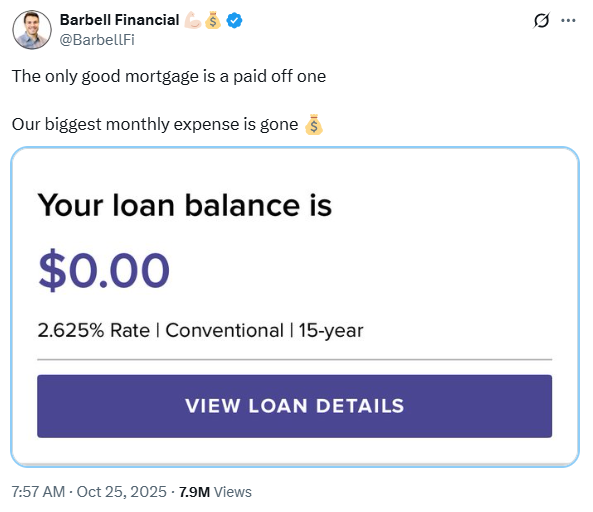

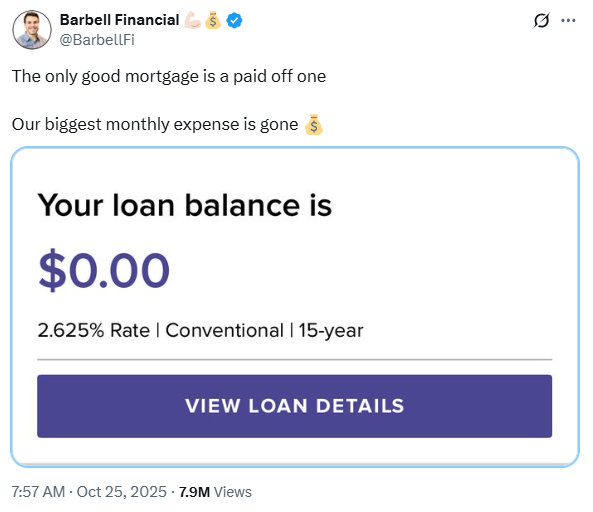

Take this guy, for instance:

He went viral for posting about how he paid off his 2.265% mortgage.

Some people were angry at this decision. Some people completely understood.

While I’m not a black or white guy when it comes to financial decisions I think this is nuts. I would never do this.

I get people wanting to pay off their mortgage because they detest debt, desire freedom from mortgage payments or simply want financial flexibility.

At 5%+ mortgage rates, sure I get that. But I cannot accept this rationale with a sub-3% mortgage rate. The inflation rate is 3%. Mortgage debt is tax-advantaged. Your house is illiquid.

Just keep the money you would have used to pay off the mortgage in T-bills or a high yield savings account. For the love of God DO NOT PAY OFF A LOW RATE MORTGAGE!!!

I wish I had borrowed even more money when interest rates were 3%.

Sometimes people take behavioral finance too far. Burying your money in the backyard might help you sleep at night but that doesn’t mean it’s a wise decision.

And guess what?

This guy doesn’t care. His mortgage is paid off. Who care what I think?

That’s another thing I learned from working in finance — most people don’t change their minds or their behavior.

Ah well.

Michael and I talked about feelings vs. finances, paying off your mortgage and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How Much is a 3% Mortgage Worth?

Now here’s what I’ve been reading lately:

Books:

1Or maybe it’s just my natural disposition?

(Source)