Today’s Animal Spirits is brought to you by Nuveen and Invesco:

This episode is sponsored by Nuveen. Invest like the future is watching. Visit https://www.nuveen.com/future to learn more.

Visit https://www.invesco.com/ to learn more about their comprehensive fixed income solutions and how they can help strengthen your portfolio’s foundation.

On today’s show, we discuss:

Listen here:

Charts:

Recommendations:

Tweets/Bluesky:

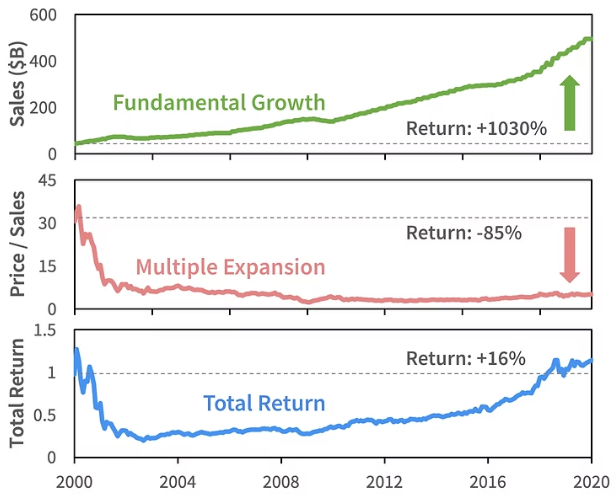

Tech’s 66% gain off the April low was the best six-month return for the sector outside 1983, 1999, and 2000. Three-year and 10-year returns have been exceptional but only roughly half the magnitude that was reached at the peak of the dotcom bubble. pic.twitter.com/yjrzesIRf1

— Rob Anderson, CFA (@_rob_anderson) October 25, 2025

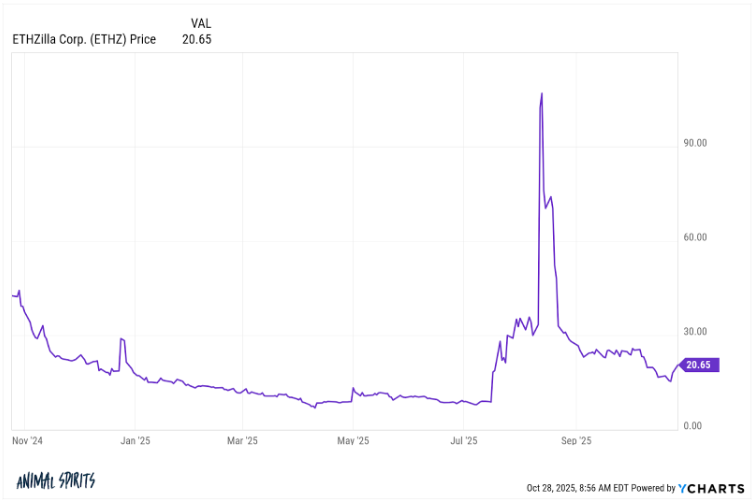

The risk to the DAT craze on the our bags has always been clear. @rektmando and I discussed it a fair bit on his show.

1) There would be too much supply of DATs. No reason to own them when you can own IBIT or ETHA ETFs.

2) They would start to trade at a discount to the… pic.twitter.com/C9KYonpOfn

— Stats (@punk9059) October 28, 2025

Reminder: Zweig breadth thrust was triggered back on April 24. 6 months have passed since the signal and the S&P 500 has gained 23.82% which makes it the 4th best signal in history. Only the ones in 1975, 1982 and 2009 have produced better gains 6 months after the signal. pic.twitter.com/d7fHsfJkjl

— CyclesFan (@CyclesFan) October 25, 2025

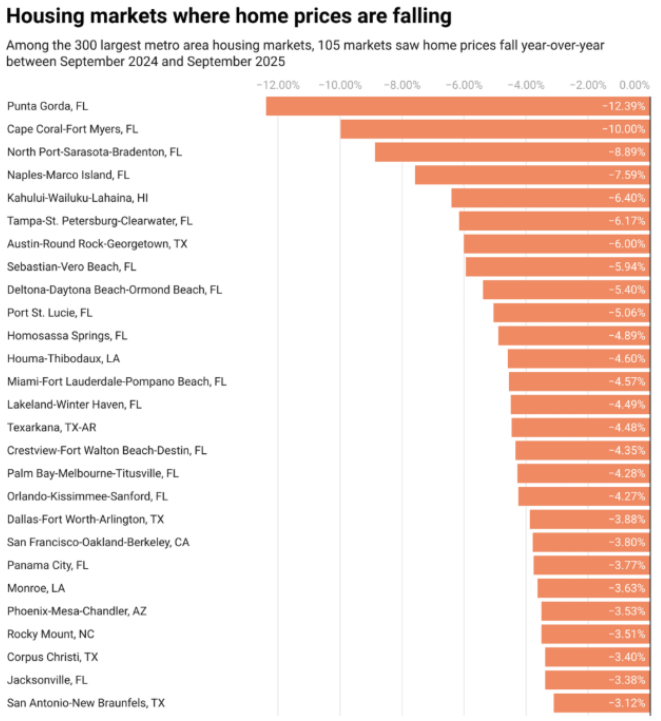

I’m begging people to go back and read the contemporaneous reporting of the housing market from spring of 2005 to mid 2006. It was meticulously documented by the mainstream press how insane consumer behavior was, and how prices subsequently began rapidly declining. https://t.co/8pOyiw2EIT pic.twitter.com/YPb9M2Zveg

— modest proposal (@modestproposal1) October 26, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

(Source)