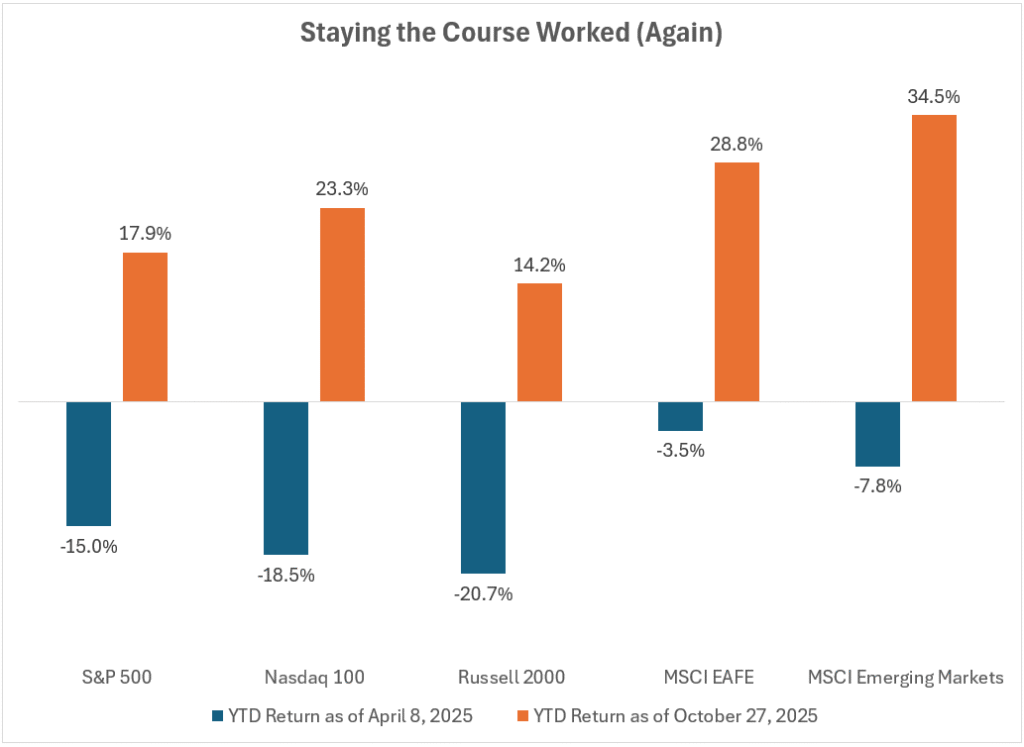

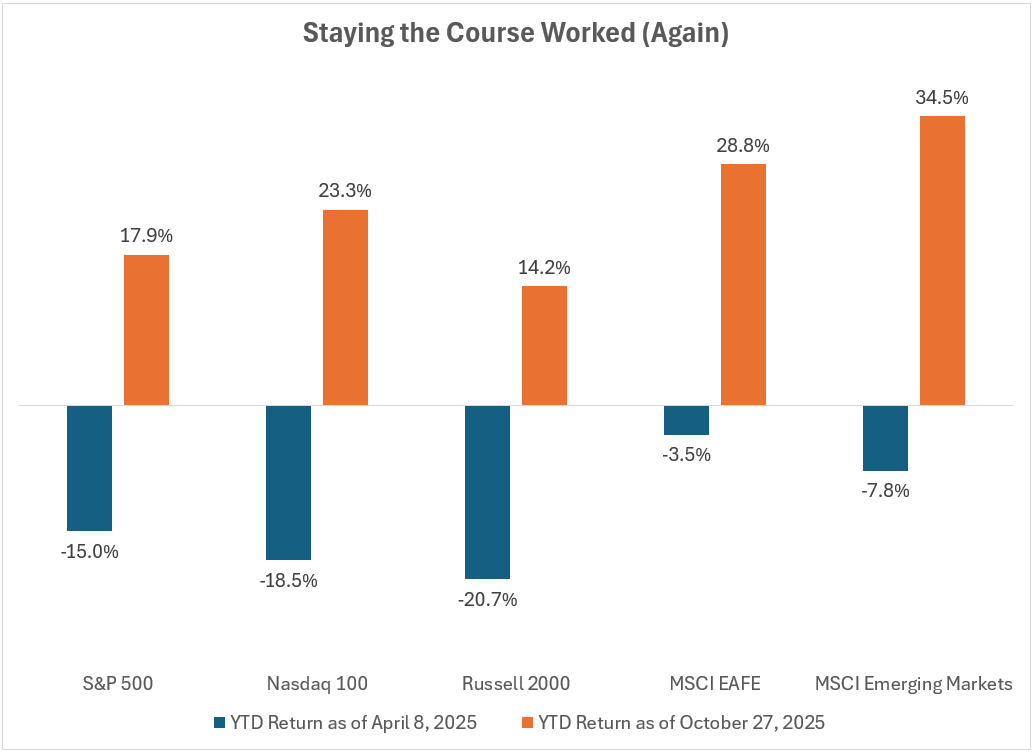

These were the total returns on a year-to-date basis as of April 8, 2025:

- S&P 500 -15.0%

- Nasdaq 100 -18.5%

- Russell 2000 -20.7%

- MSCI EAFE -3.5%

- MSCI Emerging Markets -7.8%

That wasn’t very much fun.

Now here are the 2025 year-to-date gains through the close on Monday:

- S&P 500 +17.9%

- Nasdaq 100 +23.3%

- Russell 2000 +14.2%

- MSCI EAFE +28.8%

- MSCI Emerging Markets +34.5%

That’s much better.

Here’s a visual representation about how much can change in the markets over the course of 7 months:

It’s like two completely different years and 2025 isn’t even over yet. This is the rollercoaster nature of investing in the stock market.

Things were pretty hairy in April following the tariff kerfuffle.

A lot of people bought the dip.

A lot of others were nervous about how the tariff stuff would play out.

Predicting what will happen while you’re in the midst of a downturn is often times just as hard as figuring out when a downturn will commence in advance.

When stocks are falling it always feels like it’s too late to sell but too early to buy.

This is why it’s best to take the timing out of these decisions. Invest on a regular schedule. Create a portfolio that fits with your risk profile and time horizon. Set an asset allocation that you can stick with when stocks are rising, falling or going nowhere (because they will do all of those things eventually).

Staying the course worked yet again.

Investors who panic sold now regret that decision.

Those who held on or added to their stocks when they were down are feeling much better than they were in April.

Staying the course won’t always be this easy.

Eventually we’ll get a market environment that’s more challenging without the benefit of a V-shaped recovery. A Recession. An extended bear market. A financial crisis.

These things are rare but do happen.

To be a successful investor over the long haul you need to stay the course during those painful periods too.

You also can’t spend your entire life worrying about events that happen ~5% of the time.

Most of the time the world doesn’t come to an end.

Invest accordingly.

Further Reading:

Buying When the Stock Market is Down 15%

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

(Source)